Introduction

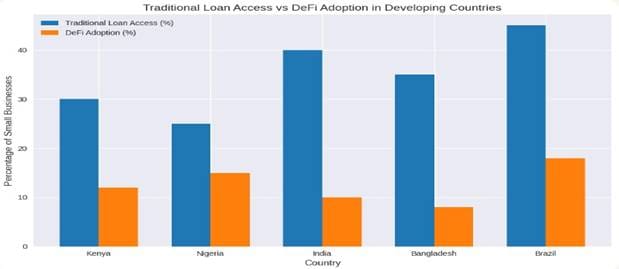

Economy of a country depends on the strength of its institutions and industry. Small and medium enterprises (SMEs) provide fuel to the developed as well as developing countries’ economies. However, stats reveal that there exists a mind-boggling $5.7 trillion of finance gap for these businesses in developing countries. Finance gap refers to the shortfall between what these enterprises need and what they actually get. Legal formalities, lack of collateral and insanely high interest rates stand in their way to getting loans from banks. Like a generous savior, decentralized finance (DeFi) tools come to fore and offer blockchain microloans and crypto loans in developing countries.

The Problem: Financing Gaps in Developing Economies

Majority of South Asia, African and South American nations are plagued with the problems of capital starvation. Multiple factors keep SMEs deprived of their well-deserved financial shares. International Finance Corporation and World Bank observe that most of SMEs in underdeveloped countries serve in the areas where banks do not operate or have desultory services.

When it comes to interest rates, Venezuela, Türkiye, Zimbabwe, Argentina and Ghana top the list of countries with highest interest rates with 59.4%, 46%, 35%, 29%, 28%, respectively. The real problems is that even if an entrepreneur is willing to return the loan such a hefty rate, the conditions imposed by banks to get the loan are often unrealistic. Lenders demand land titles or fixed assets as collateral. Since most SMEs do not have these things, loan applications are rejected.

Moreover, bureaucratic red tape slows the process of lending to such an extent that many eligible businesses stay away. Those who depend on imports to run their enterprise often suffer shortages and delays in the arrival of their required equipment. These obstacles pave way all the more for crypto loans in developing countries through DeFi lending platforms.

What Is DeFi and Why It Matters

Decentralized Finance (DeFi) refers to a financial system built on public blockchain services that do not need a third party to verify transactions. The intermediary is replaced by smart contracts, which are programs built on blockchains to keep them running smoothly. Absence of a central controlling authority removes many problems that SMEs face.

Businessmen need only an internet connection and a wallet to access DeFi. No documentation is required. As collateral, they are not supposed to possess real estate. They can acquire crypto loans on DeFi platforms by locking their digital assets. The facility becomes all the more attractive when you remind yourself of the fact that we are talking about the enterprises which operate in the areas that lack adequate banking services.

DeFi Tools for Small Businesses

Various decentralized financial services and mechanisms are at the disposal of small businesses. They can use these DeFi tools to manage, borrow, or grow their funds without having to rely on traditional banks. Small business financing with crypto once seemed to be a far-fetched idea but DeFi lending platforms have turned the idea into a reality.

1. DeFi Lending Platforms (Aave, Compound, Maker and others)

Crypto blockchain world is populated by many platforms that offer loans in return for providing some share in the liquidity. Notable among them are Aave, Compound, Maker, Venus Protocol, Radiant Capital, etc. The rules for borrowing are usually coded into the smart contracts. Majority of smart contracts use overcollateralization rule for lending cryptocurrencies. For example, a businessperson can use a collateral of $ETH valuing $150 to get stablecoins worth $100.

But this might confuse the readers. Why would anyone accept less for keeping more? The answer lies in the fact that the borrowers already have digital assets on the lending platforms, and they do not want to sell them or withdraw them. They hope that the asset will appreciate in value over the time.

2. Stablecoins (USDC, DAI, USDT)

Stablecoins are the cryptocurrencies that are pegged to US dollar. Borrowing crypto other than stablecoins poses volatility risks. In the past few years, no coin other than $BTC has exhibited significant uptrend. Coins as strong as Ethereum has also been struggling to gain the same momentum. Moreover, since stablecoins are pegged to USD, businesses in the developing countries can buy or borrow $USDT, USDC, etc. as a hedge to the devaluation of their local fiat currencies. In nutshell, stablecoins for business payment offer flexibility and security simultaneously.

3. Yield Farming and Liquidity Pools

Being Proof-of-Stake project, Ethereum provides rewards to the investors who lock their capitals on their blockchain. In addition to staking rewards, liquidity providers can earn tokens by lending others and taking interest on the loan. In addition to Ethereum, many other DeFi projects provide incentives to the liquidity providers.

4. Crowdfunding via DAOs and Tokenized Microloans

Local businesses in developing countries can resort to Decentralized Autonomous Organizations (DAOs) for tokenized lending. In this mechanism, contributors of liquidity vote on grants of blockchain microloans. The lenders get interest as an incentive.

Risks and Challenges

There is hardly any doubt that DeFi provides a matchless opportunity for SMEs to grow, one must not ignore the risks associated with these options.

1. Volatility of crypto market is the single most serious risk that can probably make the gains evaporate in the blink of an eye. Stupendous wicks pick liquidity from the upper as well as lower sides to liquidate even the most careful traders. The collateral is liquidated if the price falls below certain levels. Instead of earning something, the borrower may lose even their own hard-earned money.

2. Where decentralization is a pro, it can be con when you consider that the whole DeFi world is unregulated. In case of any loss, you cannot appeal to any authority because authorities warn against investing in DeFi projects.

3. Scams are like a routine matter in DeFi world. Project managers sometimes put bugs in the smart contract so that you can only deposit but now withdraw anything. To avoid such scams. It is advisable to invest only in renowned projects.

How to Get Started — A Step-by-Step Guide for Small Businesses

1. An SME owner must learn the basics before diving into the DeFi lending world. DeFi funding for startups seems to be a great idea on paper, but the mentioned risks and challenges make it less so. After all, there is a difference between DeFi Vs traditional loans. The former is easier to get but the latter is more convenient to sustain and hold accountable in case of any mishap.

2. A non-custodial wallet is a better option for a borrower. The choices are MetaMask, Coinbase Wallet, Trust Wallet, Phantom Wallet, etc. The entrepreneur has full control over these wallets, but they must keep the keys and seed phrases well saved lest they lose everything.

3. The next step is to explore suitable lending platforms. The better option is not the one that provides more loans, rather the one that is secure and time-tested.

4. Study the liquidation risks before initiating any request. f the value of your collateral falls below protocol thresholds, automated liquidation can occur. Keep buffer collateral and consider stop-loss strategies to protect business assets.

The Future of DeFi for SMEs

The best thing that makes DeFi lending platforms appealing for SMEs is the accessibility of and convenience. Mobile-first DeFi apps, community-based DAOs, and blockchain microloans are expected to make financing faster, cheaper, and more transparent. The talk of the town is that just as crypto market has defied expectations in last 16 years or so, DeFi for entrepreneurs will also get more attractive if regulated. The most glaring example is recent DeFi adoption in Africa.

Conclusion

Micro, small, and medium enterprises in developing countries are deprived entities for being left behind by the respective governments and circumstances. DeFi emerges as a deliverer for them. Business owners need not worry about arranging unrealistic collateral for getting crypto loans. Their digital assets suffice for the purpose. However, risks and challenges in DeFi call for proper analysis before choosing this option.

FAQs

What is the main challenge small businesses face in developing countries?

Small businesses struggle to get loans due to high interest rates, lack of collateral, and complex bank procedures.

What are the main DeFi tools useful for small businesses?

Key tools include DeFi lending platforms (like Aave and Compound), stablecoins (USDT, USDC, DAI), liquidity pools, and crowdfundings.

What does the future look like for DeFi and small business funding?

DeFi is expected to make financing faster and more accessible for SMEs, especially in developing regions like Africa, as regulation and adoption improve.

This is an educational article published in the crypto and blockchain education section. It doesn’t contain any investment advice. Please consult experts and DYOR before making any investment.

Umair Younas is a veteran crypto journalist with 6 years of experience. He writes on various categories including Bitcoin ($BTC), blockchain, Web3 and the broader decentralized finance (DeFi) space. He pens well-researched price analysis and prediction articles in addition to credible news articles. He writes easy-to-grasp educational articles to fulfil his aim of creating blockchain awareness.

I found your weblog site on google and examine a couple of of your early posts. Continue to keep up the excellent operate. I just further up your RSS feed to my MSN Information Reader. Searching for forward to reading more from you afterward!…

Would you be enthusiastic about exchanging hyperlinks?

Dead indited articles, Really enjoyed reading through.