Bitcoin restaking has quickly become one of the most searched trends in late 2025. According to industry trackers, searches for ‘Bitcoin restaking’ surged more than 300% in the last quarter of 2025. This hype is mostly driven by post-halving excitement and BTC’s climb above $100,000. But while social feeds and X threads highlight attractive yield snapshots, very few discuss the underlying risk scenarios or the lack of empirical slashing data. This guide breaks down what Bitcoin restaking really is, how new liquid strategies work, and what risks investors must understand before participating.

What Is Bitcoin Restaking?

Bitcoin restaking refers to using Bitcoin for additional yield beyond simple holding or staking on wrapped protocols. It works similarly to Ethereum’s EigenLayer, where users deposit BTC or wrapped BTC and let the protocol use it to support other networks. In return, they earn additional rewards. At the same time, users receive liquid restaking tokens (LRTs), which let them stay flexible and use their BTC in DeFi without locking it away completely. Overall, it is a way to get more out of Bitcoin while still keeping access to your funds.

Why Interest in Restaking Is Exploding in 2025

Interest is increasing multifolds in 2025 due to the ongoing financial situation. Several macro and technical factors explain the surge:

1. Post-Halving Demand for Passive Yield

With block rewards reduced again with 4th Bitcoin halving in April 2024, BTC holders increasingly seek non-custodial, yield-bearing strategies. People are constantly in search of passive income strategies due to rising inflation which brings them to restaking.

2. BTC above $100,000 Created Strong Incentives

Higher asset prices push users to maximize productive value, similar to 2021’s DeFi boom but with more conservative risk frameworks. With price rising non-stop, traders hold longer and use restaking as a cherry on top.

3. Liquid Staking and LRTs Are Going Mainstream

New Bitcoin liquid restaking protocols have emerged with some issuing BTC-backed LRTs that can be used in DeFi for lending, borrowing, and farming.

The Data Gap: Why Risk Is Hard to Measure

Despite its growing adoption, Bitcoin restaking still lacks real historical stress-test data. There have been no major slashing events yet which means security claims remain untested in real-world failures. There are also no records of liquidity crunches which makes it unclear how liquid restaking tokens (LRTs) would behave during a sharp Bitcoin crash. While there are many projections, there is no concrete data to show how these systems might handle the higher volatility expected in 2026. Because of this information gap, users must rely on theory, audits, and simulations rather than proven market evidence.

How Bitcoin Liquid Restaking Works (Simple Breakdown)

Bitcoin liquid restaking works through a simple process. First, users deposit their $BTC or wrapped versions like $wBTC or $FBTC. In return, the relevant protocol issues a liquid restaking token (LRT), such as $stBTC, $lBTC, or $rBTC, which represents their staked and restaked Bitcoin. The platform then uses this BTC to support additional network functions, including rollup security, oracle services, data availability layers, and sidechains. As this happens, users earn restaking rewards paid in $BTC, stablecoins, points, or partner tokens. The LRT remains usable throughout the process, allowing holders to borrow, provide liquidity, farm rewards, or trade without unstaking.

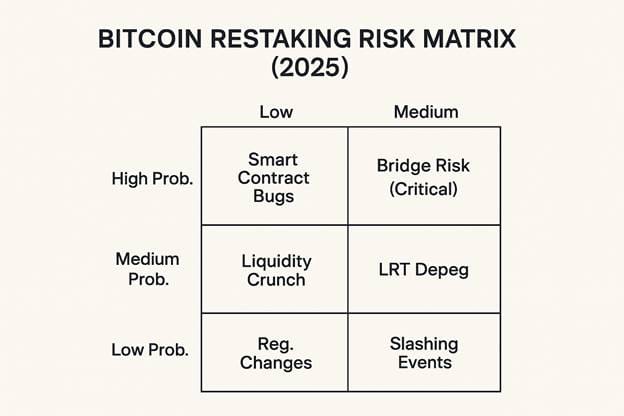

A Custom Risk Matrix for 2025–2026

A simple risk matrix helps explain the main concerns around Bitcoin restaking. There are 6 types of risks surrounding BTC restaking.

Slashing risk is considered low in probability but high in impact. It is because protocols claim strong security but lack real historical evidence.

Smart contract bugs carry a medium probability and a medium to high impact because these systems rely on complex contract layers, wrapping mechanisms, and cross-chain communication.

Bridge risk remains one of the most serious issues, with a medium probability and a very high impact, since bridges have been the biggest attack vector in crypto history.

Liquidity crunch risk also sits at a medium probability with a medium impact, as LRT liquidity can dry up during market stress, potentially triggering exit queues. L

RT depeg risk is another major concern, with a medium probability and a high impact if tokens fall below the value of BTC.

Lastly, regulatory risk ranges from low to medium probability and has a medium impact, as yield-bearing Bitcoin products may draw attention from regulators in different regions.

How to Set Up Bitcoin Restaking Safely: A Beginner-Friendly Guide

1. Choose a Reputable Platform

First of all, look for a reliable platform with the following points:

Before finalizing a platform, have a look at its audits and scan its public security modules. Transparent slashing conditions should also be analyzed and see if its provides clear collateral management.

2. Bridge Safely

After finalizing the platform, you need to bridge it safely. It is recommended to use only official cross-chain bridges with strong histories and real-time monitoring dashboards.

3. Review LRT Mechanics

It is also necessary to check the properties of the liquid restaking token as well. First of all, check what backs the token? When will the supply unlock? Moreover, also check the oracle pricing mechanisms.

4. Start With a Small Allocation

Don’t jump all in at once. It is always good to test with small amount. Avoid restaking your entire Bitcoin holdings. Treat restaking as an experimental yield strategy.

5. Monitor Liquidity Pools

Before using LRTs in DeFi, analyze available liquidity to understand exit slippage. Don’t become exit liquidity for whales.

6. Track Platform-Specific Risks

Each restaking protocol may support different validation modules with varying risk profiles. So, have an in-depth study of the platform you select.

Should You Use Bitcoin Restaking in 2026?

Bitcoin restaking offers an attractive blend of yield, liquidity, and cross-chain utility. It looks poised to evolve into a leading sector within Bitcoin DeFi, especially as 2026 volatility creates demand for new passive income strategies. However, the biggest risk remains the unknowns. With almost no historical slashing data, no major liquidity crunch events, and limited real-world stress testing, caution is essential. For now, Bitcoin restaking works best for:

• Users comfortable with experimental DeFi

• Investors seeking liquid yield options

• Those who diversify across multiple risk tiers

• It is not ideal for ultra-conservative holders or long-term cold storage users.

Conclusion

Bitcoin restaking in 2025 is unlocking new liquidity opportunities and reshaping how BTC can be used across blockchain ecosystems in 2026. The yields are appealing, but the lack of historical data means users must rely on proactive risk management and platform research.

FAQs

What is Bitcoin restaking?

Bitcoin restaking allows users to reuse their $BTC to secure additional networks while earning extra rewards through liquid restaking tokens.

How does Bitcoin liquid restaking work?

You deposit BTC or wrapped BTC, receive an LRT, and earn yields while still being able to use the token in DeFi for liquidity.

What are the risks of Bitcoin restaking?

Key risks include bridge failures, smart contract bugs, liquidity crunches, and potential slashing.

Are Bitcoin liquid restaking tokens safe?

LRTs offer flexibility but can face depeg, low liquidity, or technical failures during market stress. Users should check audits and liquidity depth.

This article is for informational purposes only and is not financial or investment advice. Crypto markets, including BTC and restaking, are risky. Always do your own research before making an investment in cryptocurrency.

Umair Younas is a veteran crypto journalist with 6 years of experience. He writes on various categories including Bitcoin ($BTC), blockchain, Web3 and the broader decentralized finance (DeFi) space. He pens well-researched price analysis and prediction articles in addition to credible news articles. He writes easy-to-grasp educational articles to fulfil his aim of creating blockchain awareness.