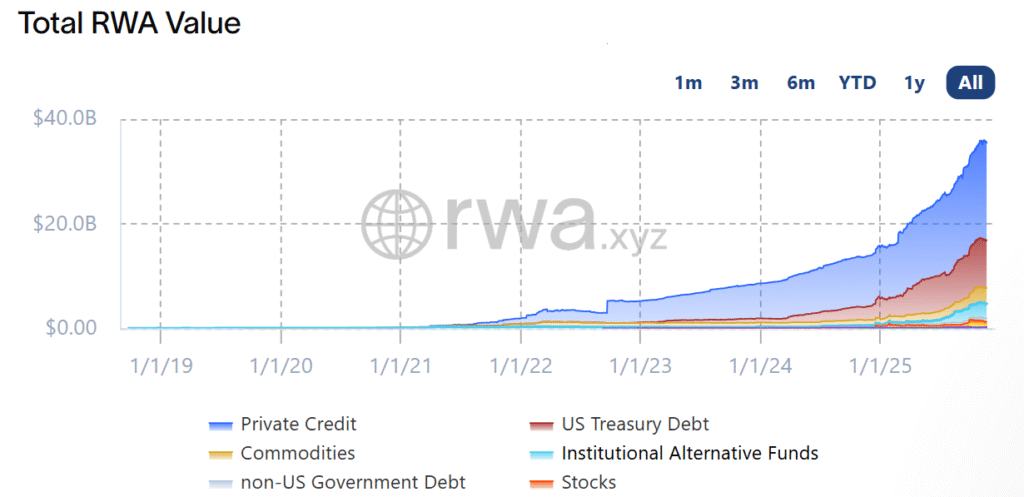

The tokenization of real-world assets has moved from experiment to mainstream financial infrastructure faster than almost anyone anticipated. As per data from RWA.xyz, $35.70 billion worth of real estate, private credit, government bonds, and commodities are now live on blockchains. BlackRock now manages the largest tokenized money market fund with around $3 billion in assets. Goldman Sachs, HSBC, UBS, and Société Générale run active tokenization programs. On government level, Singapore, Hong Kong, Switzerland, and the European Union have all issued or authorized tokenized bonds. What started as a niche DeFi trend in 2019-2020 has become one of the most important bridges between traditional finance and blockchain technology in 2026.

What is Tokenization of RWAs?

Tokenization is the act of issuing a blockchain token that legally represents ownership in an off-chain real asset. That token can represent full ownership of something like a painting or a bar of gold, or it can represent a fractional share of a much larger asset. The token itself is just code, usually an ERC-20 or any other security-token standard, but it is backed by ironclad legal agreements or trusts that make the digital token enforceable in the real world.

When you buy a tokenized piece of real estate on RealT or Lofty, you are not buying “crypto exposure” to real estate., you are buying actual legal ownership through an LLC that holds the deed. The token you receive in return is your membership certificate in that LLC. When you purchase shares of BlackRock’s BUIDL fund, you own real shares in a regulated money-market fund that happens to settle on Ethereum or Polygon. The blockchain layer handles transfer, settlement, and often income distribution, but the underlying asset remains exactly what it always was.

How the Tokenization Process Works in Practice

The journey from physical asset to tradable token follows a surprisingly standardized path in 2026. It begins with an asset owner or sponsor who wants to unlock liquidity or reach a broader investor base. A law firm in the Cayman Islands, British Virgin Islands, Luxembourg, or Singapore sets up a bankruptcy-remote special-purpose vehicle. That SPV acquires the asset or the loan portfolio and becomes the legal issuer of the tokens.

Investors go through full KYC and AML checks, often using reusable on-chain identity solutions like Polygon ID, Civic, or dock.io. Once verified, their wallet addresses are whitelisted by the token’s smart contract. The tokens are then minted and distributed. From that moment forward, ownership transfers happen instantly on-chain instead of through weeks of paperwork.

Income works the same way. Rent from a tokenized Detroit rental property flows into the LLC’s bank account, gets converted to USDC, and is distributed pro-rata to token holders. Interest from a tokenized syndicated loan or Treasury bond fund is paid out in the same automated fashion. Moreover, redemption, when allowed, is simply burning tokens and receiving fiat wired to your bank account or stablecoins sent to your wallet.

The Assets That Have Been Tokenized So Far

U.S. Treasuries and money market funds now dominate the RWA space. BlackRock’s BUIDL fund, Franklin Templeton’s OnChain money fund, and Ondo Finance’s $OUSG and $USDY products have brought billions of dollars on-chain. These tokenized Treasuries trade at a premium in DeFi because they can be used as ultra-high-quality collateral on Aave, Compound, Morpho, and Pendle, earning extra yield while remaining fully redeemable 1:1.

Private credit has seen even faster relative growth in the meantime. Centrifuge, Maple, Goldfinch, Credix, and Figure have tokenized over $4 billion in senior-secured loans to small- and medium-sized businesses, real estate developers, and consumer-finance companies. Before, these assets were locked up in private funds with multi-year lockups but now accredited investors can buy and sell exposure in seconds.

Real estate tokenization has also matured dramatically. Platforms like RealT, Lofty, Parcl, and Propy have tokenized hundreds of individual properties across the United States, Europe, and Latin America. An investor in Germany can own 0.5% of a single-family rental in Ohio and receive daily rent in $USDC (property-management fees are deducted). Larger commercial deals are also common. Centrifuge and Figure have brought entire $50–$200 million portfolios of multifamily and industrial properties on-chain.

Commodities, especially gold, remain popular. Pax Gold and Tether Gold each back more than 50 tons of allocated gold in Swiss and London vaults. Carbon credits have carved out their own niche, with Toucan Protocol, KlimaDAO, and Moss Earth tokenizing millions of tons of verified offsets.

Even traditional equities and ETFs are appearing in tokenized form. BackedFi issues bAAPL, bGOOGL, and bCOIN tokens that track the price of Apple, Alphabet, and Coinbase shares. Moreover, these tokens are fully collateralized by the underlying stocks held at European custodians.

Why Institutions Are Embracing Tokenization

Institutions are embracing tokenization because of their multiple advantages. These advantages are no longer theoretical. Fractional ownership means a $20 million building can be sold to 20,000 investors instead of one or two. 24-hour global trading means liquidity for assets that previously changed hands once a decade. Settlement drops from T+2 or T+30 to instantaneous. Administrative costs plummet because fund administrators, transfer agents, and custodians are partially replaced by transparent smart contracts.

Compliance itself has become programmable thanks to tokenization. Tokens can be coded to only transfer between whitelisted addresses, to freeze automatically if a regulator demands it, and to report capital gains information directly to tax authorities. BlackRock, Hamilton Lane, and KKR all use Securitize’s platform precisely because it embeds these regulatory requirements into the token layer.

The Regulatory Landscape in Late 2025

Europe’s MiCA regulation, fully in force since January 2025, has provided the clearest framework yet for tokenized securities and stablecoins. SIX Digital Exchange of Switzerland and Liechtenstein’s financial regulator have been issuing licenses for years. Singapore’s Project Guardian has brought DBS, Standard Chartered, and BlackRock together to test tokenized foreign exchange and bond funds with the Monetary Authority of Singapore’s blessing.

In the United States, progress is slower but real. The SEC has approved dozens of Regulation D and Regulation A+ tokenized offerings. Wyoming, Delaware, and Vermont continue to refine their blockchain-friendly laws. Moreover, multiple issuers are in the late stages of registering tokenized funds that will be available to retail investors, not just accredited ones.

Hong Kong, Abu Dhabi, and Dubai have all launched sandbox programs that are graduating into full regulatory regimes. The global pattern is clear: jurisdictions that create sensible rules are attracting billions in tokenized issuance.

Risks That Still Matter

Tokenization has numerous advantages but is not magic. Smart-contract exploits are rare but still remain possible. Oracles that feed off-chain prices or income data can be manipulated or fail. Custodial risk has not disappeared because someone else still holds the underlying asset or cash. Perhaps the biggest risk is regulatory whiplash in jurisdictions that have not yet made up their minds.

Yet the track record in 2025 is remarkably clean. The major private-credit and Treasury platforms have operated for years without significant incidents. Insurance products and on-chain credit ratings are emerging to further reduce perceived risk. Keeping this in view, 2026 looks a prime year for RWA tokenization.

Where Tokenized Real-World Assets Are Headed

Analysts who predicted $1 trillion on-chain by 2030 are now revising their forecasts upward. Tokenized deposits from banks, wholesale central-bank digital currencies, and fully on-chain corporate bond markets are all in pilot stages. Retail access is expanding rapidly under MiCA and similar frameworks. DeFi protocols already treat tokenized Treasuries and private-credit funds as the highest-quality collateral available.

The end state is a world where every financial asset like stocks, bonds, real estate, private funds, commodities, and even invoices have a tokenized version that trades globally. The infrastructure for that world is being built right now by the largest financial institutions on the planet alongside the most innovative blockchain teams.

Tokenization of real-world assets is no longer coming. It has arrived. The only remaining question is how large a role you want to play in the trillions of dollars that are about to move on-chain.

Summary

Tokenization of real-world assets (RWAs) converts physical and financial assets into blockchain-based tokens. This way, tokenization enables fractional ownership, instant settlement, global liquidity, and automated compliance. Institutions like BlackRock, HSBC, and UBS are driving adoption as tokenized Treasuries, real estate, private credit, and commodities surpass $35 billion on-chain.

What is tokenization of real-world assets?

Tokenization of real-world assets (RWAs) is the process of converting ownership of physical financial assets into blockchain-based tokens. These assets can be real estate, bonds, gold, or private credit.

Which assets are commonly tokenized in 2025?

The most commonly tokenized assets include U.S. Treasuries, money-market funds, private credit, real estate, gold, and even stocks and ETFs. These categories represent over $35 billion in on-chain value.

Why are institutions adopting RWA tokenization?

Institutions embrace tokenization because it enables fractional ownership, global liquidity, instant settlement, programmable compliance, and 24/7 trading advantages.

What are the risks of tokenized RWAs?

Tokenized RWAs risks include smart-contract vulnerabilities, oracle failures, custodial risks, and regulatory uncertainty.

This article has been written only to enhance knowledge and understanding of readers. It is not advised to trade RWA without expertise or guidance from experts. DeFi, including RWAs, is risky and could result in loss. DYOR before investment.

Umair Younas is a veteran crypto journalist with 6 years of experience. He writes on various categories including Bitcoin ($BTC), blockchain, Web3 and the broader decentralized finance (DeFi) space. He pens well-researched price analysis and prediction articles in addition to credible news articles. He writes easy-to-grasp educational articles to fulfil his aim of creating blockchain awareness.