Bitcoin ($BTC) is again experiencing price consolidation below a noteworthy resistance level. At the same time, the on-chain data highlights the rising structural stress around the surface. As per the exclusive Week On-Chain report of Glassnode, Bitcoin’s trading volumes are still muted amid the gradually rebuilding spot demand. Along with that, the options and derivatives markets are presenting increasingly passive positioning. Such a combination indicates the influence of solid expansionary demand on the price stability.

Bitcoin Price Struggles Around STH Cost Basis

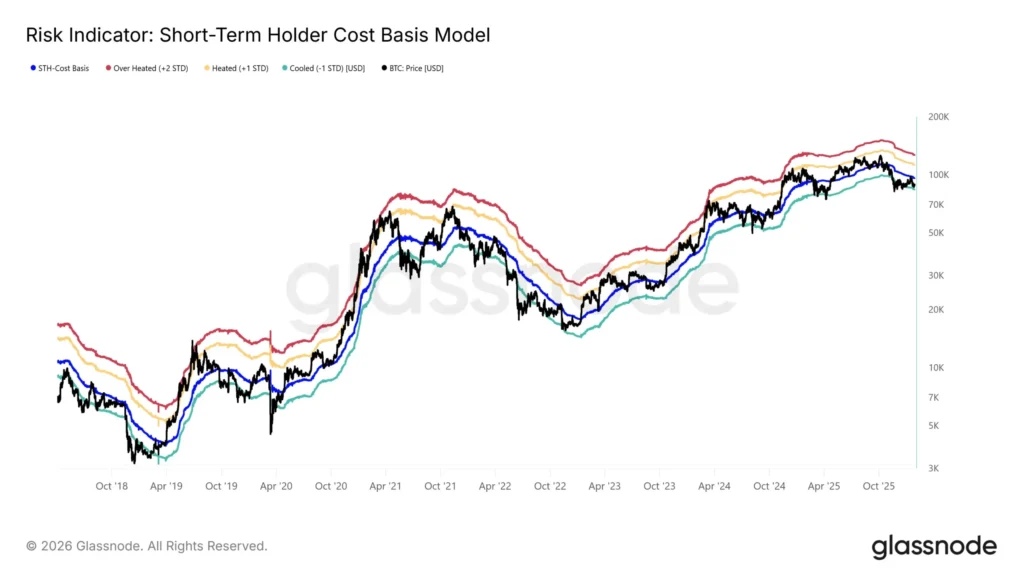

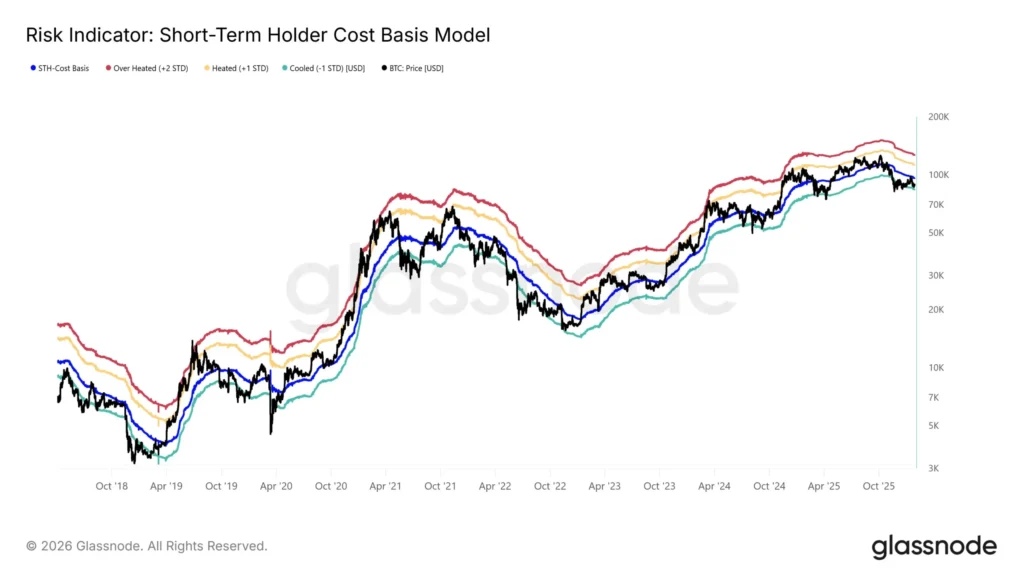

The market data indicates that the flagship crypto asset remains bound near critical on-chain cost basis marks, marked by active testing of holder conviction. Additionally, the failure to maintain a surge above the Short-Term Holder (STH) Cost Basis, around $96.5k, has led the market into a pullback. The respective structure assimilates historical periods seen in 2018’s 2nd quarter and 2022’s 2nd quarter. These phases preceded deeper corrections or consolidation.

Apart from that, short-term holders are also still vulnerable, while a meaningful portion of the recently added supply is currently held at a notable loss. Though STH supply’s 19.5% is currently underwater, significantly below the 55% neutral threshold, these members are usually more sensitive when it comes to price vulnerability. Because of this, the support zone existing between $80.7K and $83.4K is emerging as the ultimate defensive spot against a wider bearish transition.

Moreover, the liquidity conditions have emerged as an important variable for upcoming directional move. Keeping this in view, the report points out that sustained upside periods normally need liquidity-sensitive metrics, like the Realized Profit/Loss Ratio, to surge and retain position over key thresholds. Hence, without a meaningful spike in inflows, $BTC faces risk of persistent consolidation.

Why This Matters

Bitcoin’s consolidation near key resistance reflects more than short-term indecision. It signals a fragile balance between weakening momentum and cautious investor positioning. With short-term holders under pressure, muted spot demand, and defensive derivatives activity, the market lacks the liquidity needed for a sustained breakout. This setup raises the risk of prolonged consolidation or sharper downside moves if confidence fails to return, making the coming weeks critical for Bitcoin’s near-term direction.

Defensive Positioning in Options Markets Increases Downside Sensitivity

According to Glassnode, off-chain indicators reaffirm Bitcoin’s ($BTC) cautious tone. In this respect, the U.S.-based $BTC ETF flows also show stability, with the thirty-day average shifting toward relatively neutral levels following extended outflows. However, the options markets display increasing defensiveness, raising downside sensitivity in addition to triggering risk of abrupt moves amid volatile periods. Therefore, until solid conviction and liquidity return, the market remains notably vulnerable to deeper correction below crucial support levels or prolonged consolidation.

This article is for informational and educational purposes only and does not constitute trading advice. Cryptocurrency markets are highly volatile so readers should conduct their own research or consult experts before making any investment. The author and publisher are not responsible for any financial losses incurred.

Umair Younas is a veteran crypto journalist with 6 years of experience. He writes on various categories including Bitcoin ($BTC), blockchain, Web3 and the broader decentralized finance (DeFi) space. He pens well-researched price analysis and prediction articles in addition to credible news articles. He writes easy-to-grasp educational articles to fulfil his aim of creating blockchain awareness.