The stablecoin ecosystem is going through the most severe decline of the current cycle. As a result, this has raised concerns about investor sentiment and liquidity shortage. As per CryptoQuant data, ERC-20 stablecoins have recorded a $7 billion dip in cumulative supply within 1 week. This abrupt contraction indicates investor withdrawals from crypto platforms.

Drop in ERC-20 Stablecoin Market Cap Signals Wider Liquidity Exit

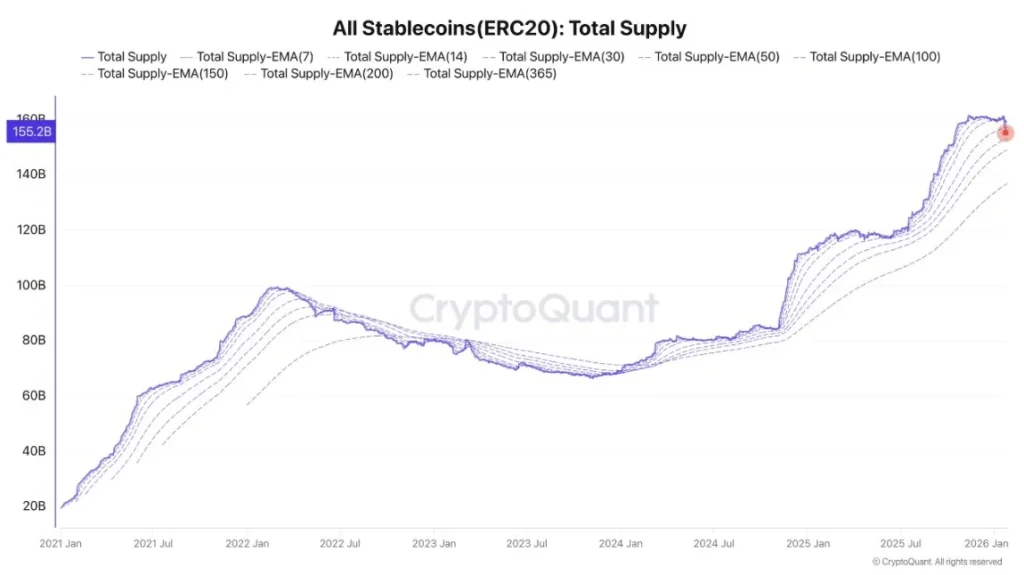

The market data reveals that a dramatic shift has occurred in the stablecoin market, with $7B leaving the ERC-20 stablecoin supply over seven days. Hence, the supply has plunged from the $162B mark to $155.2B in the meantime. So, while the investors are seemingly pulling out capital in great amounts, analysts warn about the potential start of a deeper correction in the case of failed attempts at market stabilization.

Previously, following solid expansion between early 2021 and early 2022, the stablecoin market has witnessed extended decline throughout 2023. This trend continued until the recovery in 2024. Nonetheless, the latest dip during 2026 has disrupted the respective recovery. As a result, exponential moving averages (EMAs) through diverse timeframes are now highlighting weakening momentum. Additionally, it also suggests that the liquidity is quitting the crypto landscape. In line with this, the investors are potentially moving toward the other assets amid the broader bearish outlook.

Why This Matters?

Stablecoins are the core source of liquidity in crypto. So a $7 billion weekly outflow signals strong risk-off sentiment. It means that investors are reducing exposure or moving capital out of the market entirely. This can lead to lower liquidity, higher volatility, and weaker price support. If stablecoin inflows do not recover soon, the broader crypto market may face a deeper and longer correction, especially for altcoins.

Strong Precious Metal Rally Attracts Capital, Further Weakening Crypto Sentiment

As the CryptoQuant analyst points out, this downturn parallels the robust rally of the precious metals like silver and gold. They are attracting massive amounts of capital from the investors engaged in risk aversion. Thus, the investors looking for safe havens amid the rising global uncertainty are moving toward these assets.

In the meantime, equities are showing underlying strength, providing yields for which the crypto market is currently struggling. This capital allocation shift underscores the wider search for relatively stable opportunities. Keeping this in view, if inflows do not return rapidly, the crypto sector could enter an extended correction phase, heavily influencing investor confidence in the near term.

This article is for informational purposes only and reflects market data and analysis. It does not constitute financial, investment, or trading advice. Crypto markets move fast so always do your own research before making any financial decisions.

Umair Younas is a veteran crypto journalist with 6 years of experience. He writes on various categories including Bitcoin ($BTC), blockchain, Web3 and the broader decentralized finance (DeFi) space. He pens well-researched price analysis and prediction articles in addition to credible news articles. He writes easy-to-grasp educational articles to fulfil his aim of creating blockchain awareness.