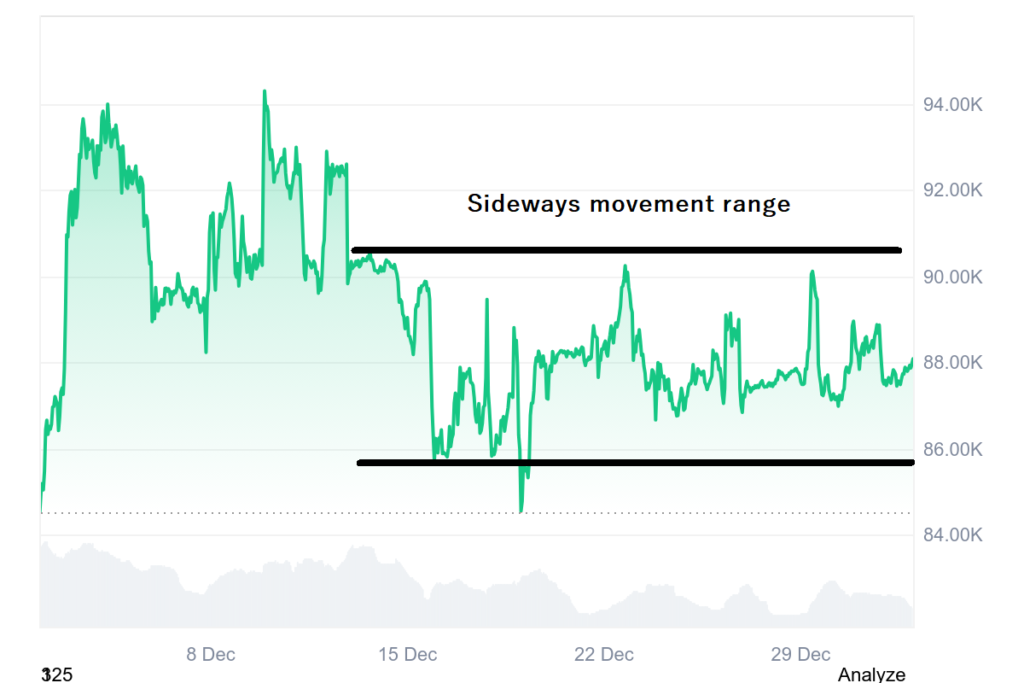

As the year 2026 starts, the market trajectory of Bitcoin ($BTC) remains uncertain. The market has not yet confirmed a decisive breakout, so the traders are still waiting for confirmation of patterns. The current outlook of Bitcoin ($BTC) suggests that volatility is dominant over price action. As per the data from a prominent crypto analyst of CryptoQuant, the ongoing ETF outflows and deleveraging could play a crucial role in shaping the future market momentum. At the moment, Bitcoin ($BTC) seems to remain range-bound between $86,000-$91,000. Remember that $BTC failed to reach the expected price targets for 2026.

Stalled Bitcoin Price Movement Makes Range-Bound Scenario Most Plausible for 2026

Based on the on-chain data, the leading crypto asset is caught between bearish caution and bullish hopes amid the overall market uncertainty. This indecision builds on the ETF outflows as well as the sharp fluctuation of exchange netflows of Bitcoin ($BTC) throughout 2025. Particularly, this signals inconsistent investor behavior and lack of conviction.

Apart from that, at 2025’s close, the price of the flagship cryptocurrency stood at approximately $87,600. This price level is well below Bitcoin’s ($BTC) mid-2025 highs around $120,000, reaffirming the range-bound structure. In specific months, $BTC’s netflows jumped above 30K $BTC, whereas the sheer outflows of around -25,000 $BTC displayed risk-off sentiment moments.

At the same time, the volatile activity across exchanges is a sign of trader reactivity to provisional macro signals instead of commitment to long positions. The respective outlook could result in 3 key scenarios for the potential of $BTC in 2026. The 1st one is the Scenario A with high probability. In this case, Bitcoin ($BTC) could trade within the $80K-$140K range.

Potential Recession Risks and Persistent ETF Outflows Could Shape $BTC’s Price Trajectory

Subsequently, the CryptoQuant analyst’s 2nd projected case for Bitcoin’s price trajectory is Scenario B with medium probability. In this scenario, the analyst predicts a plunge within the $80K-$50K range amid a potential rise in recession risks as well as ETF outflows. However, the 3rd case is Scenario C, which comes with a low probability. In such a case, Bitcoin ($BTC) could witness stable inflows in the ETF sector to hit the $120K-$170K range crossing the existing BTC all-time high. However, as the market navigates through early 2026, several changes could alter this outlook.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile. Readers should conduct their own research before making any investment decisions.

Umair Younas is a veteran crypto journalist with 6 years of experience. He writes on various categories including Bitcoin ($BTC), blockchain, Web3 and the broader decentralized finance (DeFi) space. He pens well-researched price analysis and prediction articles in addition to credible news articles. He writes easy-to-grasp educational articles to fulfil his aim of creating blockchain awareness.